What is Home Equity and Home Value?

A primer on how to keep track of your home equity

Homeowners often find themselves caught up in the numbers game, constantly comparing their home’s value to their neighbors’ or even the assessments provided by property tax assessors. While these figures can be interesting, they’re not the most crucial metric to focus on. The more important number is home equity.

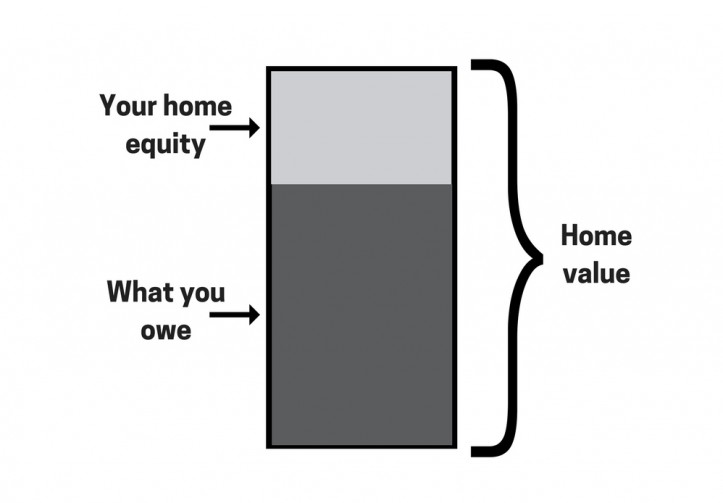

Home equity is the difference between your home’s current market value and the amount you still owe on your mortgage. For example, if your home is worth $500,000 and you owe $200,000 on your mortgage, your home equity is $300,000. This figure represents your ownership stake in your home, and it’s a valuable asset that can be tapped into for various financial needs.

Home improvements can certainly impact your home’s value, but it’s important to consider the potential return on investment. In a hot real estate market, a new kitchen might significantly increase your home’s value, but in a slower market, the return might not be as substantial. Regardless of the market conditions, focusing on home equity provides a more accurate picture of your financial situation and potential wealth.

What is home equity?

Home equity is the portion of your home’s value that you own outright. It’s the difference between the current market value of your home and the amount you still owe on your mortgage.

Think of it this way: When you bought your home, you likely made a down payment. This down payment became your initial equity. For example, if you purchased a $500,000 home with a 20% down payment of $100,000, your initial equity was $100,000.

As you make mortgage payments, a portion of each payment goes towards paying down the principal (the original loan amount). This means you’re gradually reducing the amount you owe to the bank. As a result, your equity in the home increases over time.

At Sweeten, we’re experts at all things general contractors — we pre-screen them for our network, carefully select the best ones for your remodeling project, and work closely with hundreds of general contractors every day. So, we’ve tapped our internal expertise to bring you this guide.

In essence, your home equity is your financial stake in your property. It’s a valuable asset that can be used for various purposes, such as home improvements, education expenses, or even retirement.

Your home equity also grows when your home appreciates and shrinks when your home depreciates. Here’s a simple diagram that shows the relationship between home value, home equity, and what you owe.

Why is home equity important?

Home equity is important because it determines how big a check you get when you sell your home. You’ll get a check for your home equity, minus fees related to the sale, such as real estate broker fees, etc. That’s pretty important!

The amount of home equity is also important if you want to refinance, as you’ll want to maintain 20% equity in your home to be able to qualify for most refinances. Sweeten brings homeowners an exceptional renovation experience by personally matching trusted general contractors to your project, while offering expert guidance and support—at no cost to you. Renovate expertly with Sweeten

Home equity changes as your home value changes

Now, let’s talk about what happens when the value of your home goes up. If your home value is $500,000 when you buy it, but in five years it’s worth $550,000, congratulations! You have $150,000 in home equity instead of just the $100,000 from your down payment. Your home equity can also shrink if home prices drop.

An increase in home equity from a renovation is your return on investment.

Home equity before and after renovations

It’s good to think about your home equity before you begin a renovation. If your home value goes up from a renovation, your home equity increases accordingly. An increase in home equity from a renovation is your return on investment.

If a project costs you $10,000, and it raises your home value by $10,000, then your return on investment would be 100%. When it’s time to sell your property, you’ll get that $10,000 back (assuming the enhancement holds its value until the time you sell).

Home equity loans and renovations

When considering a home renovation, it’s essential to assess your home equity position. This is particularly important if you plan to use a home equity loan to finance the project.

Home equity is the difference between your home’s current market value and the amount you still owe on your mortgage. If you owe more than your home is worth, you have negative equity.

Taking out a home equity loan can reduce your home equity. This is because the loan increases your overall mortgage debt. However, if the renovation significantly increases your home’s value, the net effect on your equity might be positive.

It’s crucial to be mindful of your home equity percentage. Lenders generally prefer borrowers with at least 20% equity in their homes. If your equity dips below this threshold, you may face difficulties refinancing your mortgage or securing future loans.

Before taking out a home equity loan, carefully consider the potential costs and benefits. While a renovation can enhance your home’s value and improve your quality of life, it’s important to weigh these factors against the potential impact on your financial situation.

An easy, 3-step way to know your home equity at any point in time

First, find your home’s current value. Do a search online for homes sold in the last six months and find three that are most like yours in terms of size, location, and interior condition. Use these to extrapolate a general home value based on current sales.

Second, take a peek at your mortgage statement, either online or your printed statement, however you receive it. Look for the “remaining loan balance” or “remaining principal balance” field. Add to that amount any other outstanding loans you have on your home.

Third, take your home value and subtract what you owe. That’s your home equity.

Home equity as major net worth

A U.S. Census report update from 2017 stated that homeowners have on average nearly 69% of their net worth in their home equity! Yet, it remains a mystery to most homeowners.

By being aware of your home equity, you’ll better protect your net worth and have greater control and awareness of your financial opportunities related to homeownership, for both the short and long term.

Nicole Hamilton is the author of Avoid the Money Pit, Turn Your Home into a Financial Powerhouse, and the founder of Homeownering, an independent and unbiased resource for homeowners to get great financial outcomes.

—

If you’re thinking of renovating your home, learn about the options available for financing a remodeling project.

Ready to start planning your renovation?

Find endless home renovation inspiration, detailed guides, and practical cost breakdowns from our blogs. You can also post your project on Sweeten today and get matched with our vetted general contractors for free!