Mortgages 101: Everything You Need To Know About Home Loans

Get paperwork organized early for your mortgage lender

If you’re a renovation buff like the rest of us at Sweeten, you might be dreaming of buying (and of course, renovating) your own piece of real estate. A crucial step in turning that dream into reality? Securing a mortgage. Here’s the lowdown:

Qualifying standards

First-time homebuyers are often overwhelmed by the process and the sheer volume of paperwork involved, but finding a reliable mortgage professional to walk you through the process is key. Even before you shop around for experts, however, you should have a sense of your own finances. This means knowing that you know the answers to the following questions:

1) Do you have a good (preferably over 700) or great credit score (typically 800 and above)?

2) How much money do you have in the bank?

3) How much monthly debt do you have compared to your monthly income?

The answers to these questions will give you an idea of how easily you’ll be able to get the mortgage you want. The best candidates have a good maximum credit score, money in the bank (for a healthy down payment of at least 20 percent*), a strong salary (to pay the monthly costs), and an acceptable level of debt, explained further below.

Mortgage bankers work with different formulas to determine the home loan amount that you qualify for, and different lenders will use varying standards. Two of the most significant, however, are the payment-to-income ratio (“housing expense ratio”), and the debt-to-income ratio (or “debt service ratio”).

Housing Expense Ratio: On a conventional Fannie Mae/Freddie Mac loan, the monthly mortgage payment (including the principal, interest, taxes, and insurance) cannot exceed a certain percent of your income (usually around 28 percent). So for example, if your gross income is $4,000 a month, your house payments cannot amount to more than $1,120 a month. There are exceptions: for loans insured by the Federal Housing Administration (“FHA-insured loans”), the percentage allowed is higher, whereas loans guaranteed by the Department of Veteran Affairs (“VA-guaranteed loans”) do not consider the payment-to-income ratio at all but instead look at residual income. [Total Income x 28% = Total Housing Expenses | EXAMPLE: $4,000 x 28% = $1,120]

Debt Service Ratio: With a conventional home loan, your recurring debt total cannot exceed a certain percent of your monthly income (usually around 36 percent). This includes your housing payments (determined above). So continuing with the example above, if you make $4,000 a month, you are allowed a total monthly debt of $1,440. Subtracting your mortgage payment, that gives you $320 to pay all of your other recurring debts, including any student loans, credit cards, car payments, etc. As with the housing expense ratio, special loans have more forgiving percentages. On an FHA-insured loan, your debt cannot exceed 43 percent of your monthly income, whereas, on a VA-guaranteed loan, your debt cannot exceed 41 percent of your monthly stable income. [Total Income x 36% = Total Monthly Debt Allowed | EXAMPLE: $4,000 x 36% = 1,440] Sweeten brings homeowners an exceptional renovation experience by personally matching trusted general contractors to your project, while offering expert guidance and support—at no cost to you. Renovate expertly with Sweeten

Getting pre-qualified or pre-approved

In a competitive market like New York City, it’s important to start the mortgage process even before you start looking at homes. It’s generally expected that, if financing is required in your home purchase, a pre-qualification or pre-approval letter accompanies the offer. So what does it mean?

Pre-qualification can be considered “pre-approval-lite”—it is usually provided after you have a quick chat with your lender about your big-picture finances. They don’t do an in-depth analysis or a credit check but can give you an estimate of the amount that you’d qualify for. A pre-qualification can take as little as 30 minutes.

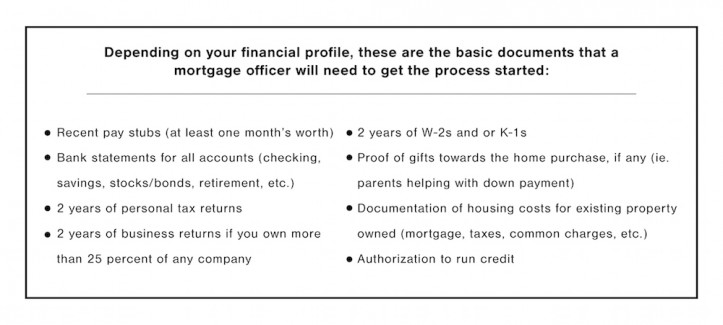

Pre-approval is more complex and requires you to supply the lender with documentation of your income and debt (rather than just providing it verbally, as with pre-qualification). This includes W-2s, tax returns, bank statements, paystubs, and more. (Get organized now! This information is much easier to gather if it’s not all in an unsorted pile under your bed.) It also involves an extensive check into your finances and credit. At the end, you receive a conditional commitment for the exact amount they are willing to loan you in a pre-approval letter. This letter strengthens any offer because it assures the seller that you can very likely obtain the actual funding. A pre-approval will usually take at least a whole business day.

If at all possible, get a pre-approval: “Most pre-qualification letters are not worth the paper they are written on, because nothing has been verified. With a pre-approval, credit, assets, and income are verified, allowing the lender to approve you for a home loan based on what you qualify for,” explains Romuald Solages, a mortgage loan officer at PowerHouse Solutions, a direct lender for mortgages to the consumer. In competitive markets, such as NYC, getting a pre-approval places you in a stronger position should you find yourself in a bidding war. It will take a little longer but it’s part of the process if you are serious about buying property with a mortgage.

All of this means that you should speak with a mortgage broker or banker prior to going to that open house (easier said than done, we know.) This process gives you an accurate estimate of how much house you can afford, based on how much you have for a down payment, as well as your financial history. Plus, once you’ve done this, you’ve drastically simplified the steps needed to take once you have an accepted offer since the lender will already have much of the information required for your application. You may need to update the info if a lot of time has passed, but you won’t be starting from scratch.

Where to find a mortgage

You don’t have to stick to your current bank for a mortgage. “Many people falsely assume that they will fare much better with their mortgage if they just use their established bank, the one they already do their banking with,” says Romuald. While many banks do advertise programs for their customers, he adds, “it’s always best to shop around.”

There are the national lenders, like Wells Fargo and Chase, but also reputable local companies like FM Loans and Freedom Mortgage. Keep in mind you are working with specific loan officers/bankers and not just an institution, and as with attorneys and agents, many people use personal references such as friends and family. Your real estate agent should be the first place you go to for suggestions if you have no contacts. Other sources include a mortgage banker or a mortgage broker—the latter are much less common after the financial crisis. The former works directly for a lender (e.g., a bank), where your loan originates, whereas the broker is a middleman, who shops around for you and connects you to a lender.

What if…

*You don’t have 20 percent to put down? While that amount is recommended in today’s market, most conventional lenders will allow you to put down as little as 10 percent (unless you are applying for a special program, such as the FHA-insured or VA-guaranteed loans). With 10 percent down, however, you will still be required to pay private mortgage insurance (PMI), which you can avoid by putting down at least 20 percent. FHA loans, which require a down payment of just 3.5 percent, are a good option for those who don’t have a lot of cash in the bank.

*You don’t have good credit? Again, FHA loans may be the answer here. Because the FHA insures the home loans, they lower the risk for the lender, allowing them to be more lenient with both the size of the down payment as well as the borrower’s credit score. The minimum FHA loan credit score is 580, which means that the borrower would qualify for maximum financing under their standards with a down payment of just 3.5 percent. If your credit score is lower than 580, you can still qualify, but will be required to put down 10 percent.

“It’s important to examine your credit reports carefully because any mistakes on your credit report could lead to a higher mortgage rate or even loan rejection. Checking your credit report with all three major credit bureaus—Equifax, Experian, and TransUnion—is free through annualcreditreport.com,” says Romuald.

Buying and renovating all-in-one loan

If you’re interested in buying to renovate, consider applying for one loan to cover both. This simplifies the process by allowing you to do just one financing application, with only one set of closing costs. The lender will calculate how much of a mortgage you’ll qualify for based on the future value of the property, so you’ll be able to obtain a larger amount than if it was based on the current value. There is in this case also an FHA option, known as an FHA 203(k) loan. For more information on buying and renovating, check out our post, Options for Financing a Home Renovation.

When you’re ready, come back to Sweeten and we’ll help you find the perfect contractor to make the house a home!

—

Not sure how much to budget for your remodel? Check out our guide on renovations costs per square foot.

Sweeten handpicks the best general contractors to match each project’s location, budget, and scope, helping until project completion. Follow the blog for renovation ideas and inspiration and when you’re ready to renovate, start your renovation on Sweeten.